Unlocking Financial Growth: A Comprehensive Guide to PPF, SCSS, and Post Office Term Deposit Amendment Rules 2023

1) PPF Or Public Provident Fund (Amendment) Scheme, 2023

"Let's dive into the nitty-gritty of PPF premature withdrawal rules, shedding light on the reasons and procedures for closing your account before its maturity. In a previous article, I explored the 2016 rules on prematurely closing a PPF account, and here, I'll break down the existing regulations.

So, why would you want to prematurely close your PPF account? There are a few valid reasons:

(a) Medical Emergencies: If you, your spouse, dependent children, or parents are facing a life-threatening disease, you can opt for premature closure. Just make sure to provide supporting documents and medical reports from the treating medical authority.

(b) Higher Education Pursuits: Planning on furthering your education or supporting your dependent children's academic endeavors? Premature closure is permitted with the submission of documents and fee bills confirming admission to a recognized institute of higher education, whether in India or abroad.

(c) Change in Residential Status: If you undergo a change in your residential status, you're eligible for premature closure. Simply furnish a copy of your Passport and visa or Income-tax return to initiate the process.

Now, let's clarify a few key points:

- Premature closure is allowed only if the account has completed 5 years from the end of the year in which it was opened, except in the case of the account holder's demise.

- For medical emergencies, make sure to provide supporting documents from a competent medical authority.

- When it comes to funding higher education, you'll need to submit fee bills confirming admission to a recognized institute, whether in India or abroad.

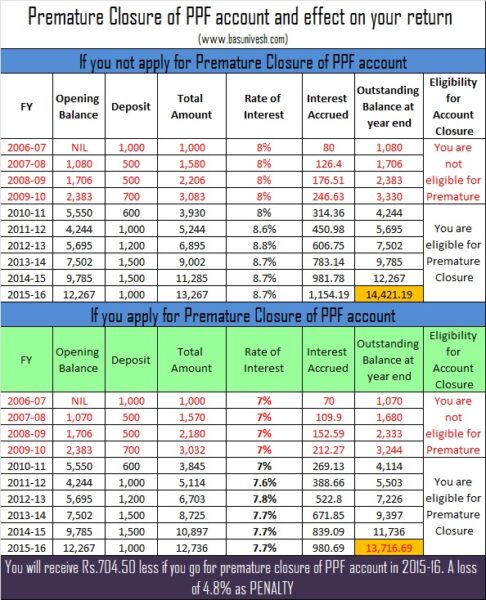

To illustrate the transition, let's compare the old rules with a practical example."

What's New in PPF Premature Closure Rules? A Closer Look at the Recent Amendments

In the ever-evolving landscape of financial regulations, understanding the changes becomes paramount. In the case of premature closure of PPF accounts, a recent tweak in the rules has brought about significant relief, especially for those with accounts aged more than 15 years.

Let's break down the modification: Previously, if you decided to close your 17-year-old PPF account, you would face a 1% deduction on the entire interest accumulated over those 17 years. The catch was, the deduction applied to the entire period. But, under the new rule, this penalty has undergone a transformation.

The updated sentence now specifies that the 1% less interest penalty will be applicable only for the current block period of five years. To illustrate, if your account has reached 17 years, the interest credited on the 16th and 17th year will bear a slight reduction, but the interest earned in the earlier 15 years remains untouched.

Similarly, for an account spanning 24 years, the 1% deduction applies only to the interest accrued from the 21st to the 24th year. The interest earned in the initial 20 years (15 years of the regular term and 5 years of the first extension) remains unaffected.

In essence, this alteration offers a substantial reprieve for those whose PPF accounts have surpassed the 15-year mark. The penalty is now confined to the current block period, sparing the interest earned in the earlier years. It's a game-changer for long-term investors, providing a more favorable scenario for those contemplating premature closure. However, it's crucial to note that this change does not impact accounts with less than 15 years in maturity.

In navigating the intricate world of PPF rules, staying abreast of such modifications is key to making informed financial decisions.

Exploring the Enhanced Senior Citizen’s Savings Scheme (SCSS) Rules in 2023

The Senior Citizen’s Savings Scheme (SCSS) has undergone noteworthy revisions in 2023, bringing about changes that offer more flexibility and benefits to senior citizens. Let's delve into the alterations one by one:

a) Unlimited Extensions:

In a significant move, senior citizens can now extend their SCSS as many times as they wish after the completion of 5 years, and each extension will be in blocks of 3 years. This newfound flexibility is a boon for those seeking long-term financial stability.

b) Adjustments in Premature Withdrawal:

Previously, during the extended SCSS period, withdrawal was permitted after one year without any penalty. The recent amendment allows premature withdrawal before one year but with a 1% penalty on the deposited amount. This introduces liquidity in the 6th year, albeit with a slight cost.

c) Extended Window for Opening Accounts:

The eligibility criteria for opening SCSS accounts have been refined, particularly for those aged 55 to 60 years who have retired. The earlier one-month limit for opening an account after receiving retirement benefits has been extended to three months, providing senior citizens with more time and flexibility.

d) Inclusion of Spouses of Deceased Government Employees:

A notable change allows the spouse of a deceased government employee, who was 50 years or above and died in harness, to open an SCSS account. This widens the scope of beneficiaries and recognizes the financial needs of surviving spouses.

e) Revised Definition of Retirement Benefits:

The definition of retirement benefits has been expanded to include death gratuity for employees who died in harnesses. This ensures that the spouse is entitled to the benefits in case of the untimely demise of the government employee.

f) Application Requirement for Joint Account SCSS Continuation:

In the case of joint accounts or when the spouse is the sole nominee, the surviving spouse must actively apply for the continuation of the SCSS account. Unlike the previous provision allowing automatic continuation, this change requires a proactive step to ensure the account remains active.

These amendments not only enhance the accessibility and options for senior citizens but also reflect a thoughtful approach to addressing their evolving financial needs. As the financial landscape evolves, staying informed about such changes is crucial for making informed decisions and securing a stable financial future.

Comments

Post a Comment